You may have already heard of the term “homeless industrial complex” . It’s usually a derogatory term referring to a network of organizations involved in addressing homelessness that actually perpetuate it due to the jobs and financial incentives involved in the effort. While multiple outreach entities rake in millions, the steady supply of people living on the streets persists and even grows.

It’s not so much a nefarious conspiracy as blind ideology, argues an article in CityWatch, an opinion, and news website out of Los Angeles, where homelessness has grown as spending on it has accelerated.

In the same vein, it looks like many of the efforts in Oregon to help immigrants in the US illegally have spurred the creation of an “Illegals Industry” that, while claiming to be positively managing a problem is spurring it. And in the process, just as with homelessness, government is lighting our money on fire.

As scholar Clay Shirky says, “An organization that commits to helping society manage a problem also commits itself to the preservation of that same problem, as its institutional existence hinges on society’s continued need for its management”. That’s the Shirky Principle at work: “Institutions will try to preserve the problem to which they are the solution.”

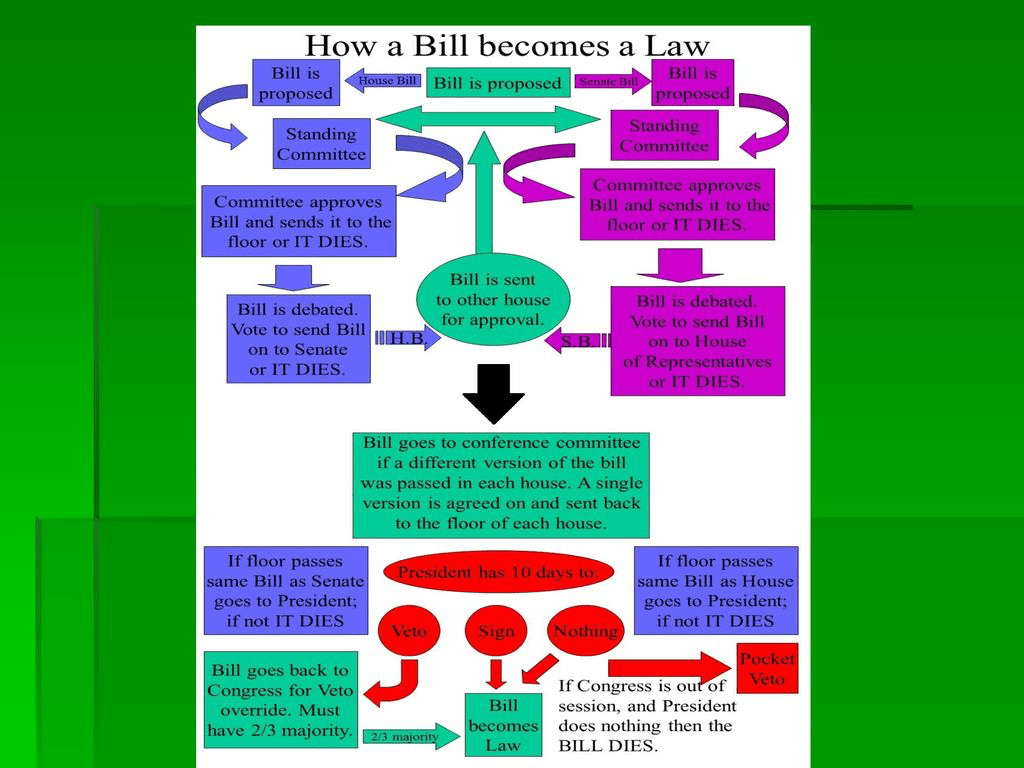

The current debate in the Oregon legislature over a Food For All Oregonians program proposed by SB 611 illustrates the the problem Illegals Industrial Complex. The program proposes providing nutrition assistance to residents of Oregon who are under 26 years of age or 55 years of age or older and who would qualify for federal Supplemental Nutrition Assistance Program benefits but for their immigration status. In other words, it would extend to people in the United States illegally food benefits equivalent to those provided under the federal Supplemental Nutrition Assistance Program (SNAP) program.

Written testimony supporting SB 611 submitted by the Oregon Food Bank to the Senate Committee on Human Services noted that the bill is supported by a coalition of more than 165 Oregon organizations.[1]

The endorsers include churches, unions, groceries, educational institutions, refugee organizations, anti-poverty groups, Planned Parenthood, health services, foster care programs, ethnic interest groups, immigrant aid groups, homeless advocates, farmers markets and a host of other social service groups.

“Immigration status shouldn’t exclude anyone from being able to feed themselves or their family,” Food for all Oregonians says.

While all may have a sincere concern for the non-citizens in Oregon, supporting state funding of free food for non-citizens also encourages immigrants to come here illegally, perpetuating the problem. As the Economic Policy Innovation Center, a conservative think tank, puts it, ” Many illegal aliens become eligible for taxpayer-funded welfare programs, costing billions of dollars annually. These benefits… are a significant pull factor for illegal immigration.”

Oregon has already expanded free health insurance that mirrors Medicaid to all residents who qualify, regardless of their immigration status. Non-citizens, including undocumented residents, also have access to Oregon driver licenses, despite Oregonians voting 66% to 44% in 2014 against giving driver’s license privileges to people without proper U.S. government documentation. The Legislature overrode voters in 2019 by pushing a bill through (HB 2015) with a clause that didn’t allow for a citizen referendum.

Several bills are also before the 2025 legislature that would offer other benefits to non-citizens.

SB 703, for example, directs the Department of Human Services to provide grants to non-profit service providers to assist individuals who are non-citizens to change their immigration status or obtain lawful permanent resident status. The bill is sponsored by 4 Democratic senators, 5 Democratic representatives and 1 Republican representative.

You can be sure Oregon’s Illegals Industry will support all of these bills, regardless of the cost or impact. .

[1] Food for All Oregonians, Campaign Endorsers

1st Baptist HOPE Food Pantry, 211 Info, Accent Network, Access Care Anywhere, Adelante Mujeres, Afghan Support Network, Afghanistan Oregon Association, AFL-CIO, African Refugee Immigrant Organization (ARIO), African Youth & Community Organization (ayco), APANO, Arab American Cultural Center of Oregon, ARISE and Shine, Basic Rights Oregon (BRO), Beyond, Toxics, Black Oregon Land Trust, Blanchet House of Hospitality, CAMPO, Cascade Aids Project (CAP), Catholic Community Services of Lane County (CCSLC), Central City Concern, Centro Cultural, Children’s Institute, Clackamas Community College, Clackamas Service Center, Clay Street Table, Columbia Gorge Women’s Action Network, Community Alliance of Lane County (CALC), Community Connection of Northeast Oregon, Inc., Community for Positive Aging – Asian Food Pantry, Community Pulse Association, Consejo Hispano, Consolidated Oregon Indivisible Network, Eastern Oregon Association for the Education of Young Children (EOAEYC), Eastern Oregon Center for Independent Living (EOCIL), Eat Drink Washington County, Ecumenical Ministries of Oregon, Educate Ya, Estacada Area Food Bank, Ethiopian and Eritrean Cultural and Resource Center, Eugene-Springfield SURJ, EUVALCREE, Familias en Acción, Family Forward, Farmers Market Fund, Feed’em Freedom Foundation, First Tech Credit Union, Food Corps NW, Food for Families, FOOD For Lane County, Food Roots, Forest Grove Foundation, Friends of Family Farmers, Gorge Grown Food Network, Growing Gardens, Guerreras Latinas, HAKI Community Organization, Hand Up Project, Healthcare for All Oregon, High Desert Food and Farm Alliance, Hood River County Board of Commissioners, Hood River Latino Network (HRLN), Human Services Coalition of Oregon, Innovation Law Lab, Interfaith Alliance on Poverty, Interfaith Movement for Immigrant Justice (IMIrJ), IRCO, Iu Mien Association of Oregon, Ka Aha Lahui Olekona, Klamath Grown, Lane Community College, Latino Community Association, Latino Network, Lending A Helping Hand, Lift UP, Living Islands Non-profit, Maihan Social and Cultural Community, Malheur County Democratic Central Committee, Medford Food Co-op, Metro City Council, Mercy Connections Inc, Micronesian Islander Community (MIC Oregon), Milwaukie Spanish SDA Church, Montavilla Farmers Market, Muslim Educational Trust, National Partnership for New Americans, Neighborhood House, New Seasons, Next Up Action Fund, Nonprofit Association of Oregon, North Coast Food Web, Northwest Center for Alternatives to Pesticides, Northwest Family Services, NOWIA Unete Center for Farm Worker Advocacy, Nutrition Garden RX, OneAdonaI (we help!), Ontario Mini Market, Oregon AFSCME, Oregon Association of Relief Nurseries (OARN), Oregon Center for Public Policy (OCPP), Oregon Farm to School & School Garden Network, Oregon Food Bank, Oregon Health Equity Alliance, Oregon Human Development Corporation, Oregon Hunger Task Force, Oregon Just Transition Alliance, Oregon Latino Health Coalition (OLHC), Oregon Law Center (OLC), Oregon League of Conservation Voters (OLCV), Oregon Organic Coalition, Oregon Public Health Association, Oregon Rural Action, Oregon School Based Health Alliance, Oregon State University-Extension, Oregon Synod, Oregon Worker Relief, Our Children Oregon, Our Community Birth Center, Pacific Refugee Support Group, Partners for a Hunger Free Oregon, Partnership for Safety and Justice, PCUN, People’s Food Co-op, Planned Parenthood Advocates of Oregon, Plaza de Nuestra Comunidad, Portland Central Kitchen, Portland Open Bible Community Pantry, Raíces, Reedsport Collective, Right To Health, Inc, RISEN Community, Rogue Farm Corps, Rogue Food Unites, Rural Organizing Project (ROP), Sanctuary Committee of Temple Beth Israel, Sarah’s Foster Care, Seed to Table Oregon, SEIU Local 503, Sisters of the Road, SnowCap, Social Justice Coalition, Central Lutheran Church, Portland, Somali American Council Of Oregon (SACOO), Somali Oregon Service Center, Springfield Eugene Tenant Association, St. Timothy Episcopal Church, Start Raising Young African Lives, Ten Rivers Food Web, Tides of Change, Tikkun Olam Committee of Temple Beth Israel, Tillamook County Board of Commissioners, Tualatin Food Pantry, Tualatin Valley Gleaners, UFCW, Unite Oregon, United Congolese Community Organization of Oregon, Urban League of Portland, VIVA Inclusive Migrant Network, We Do Better Relief, Welcome Home Coalition, Western States Center, William Temple House, Willowbrook Food Pantry, Working Theory Farm, Zenger Farm