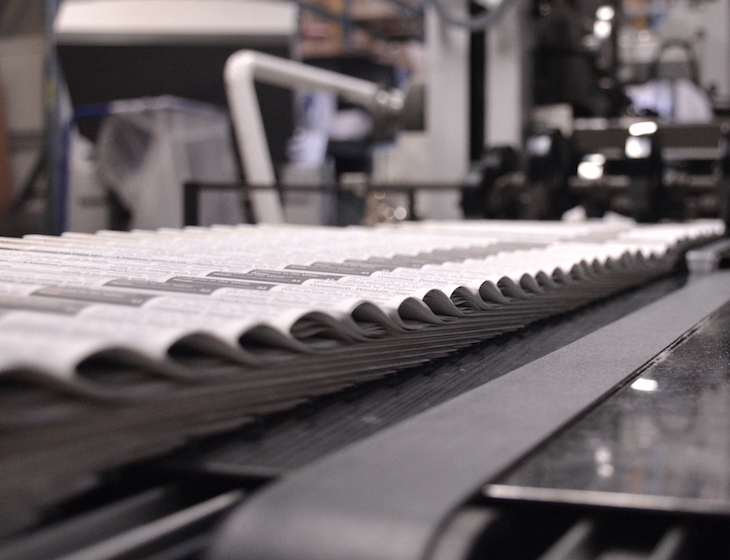

Once upon a time, printed newspapers serving local audiences were in high demand.

But over 2200 newspapers in the United States have closed in the past 15 years and the carnage continues.

Circulation has declined drastically. Pay has been cut. Advertising revenue has plunged. Newsroom employment has plummeted. The vast majority of remaining print newspapers have a circulation of less than 15,000, according to a review by the University of North Carolina’s journalism school.

It’s a grim picture, made worse by the fact that, as Harvard’s Shorenstein Center has pointed out, “Printed newspapers are a manufacturing business. For some, the non-newsgathering cost structure can be the majority of total operating expense. This means that in a world of declining demand for print editions of local newspapers, legacy costs become an increasing share of declining revenue. Much of the underlying reality of the current market failure for local news coverage can be traced to this simple fact.”

But the newspaper industry and some members of Congress think they have found a solution — a federal taxpayer bailout.

This is the wrong solution. And, frankly, it’s embarrassing.

America’s journalism industry, which until now has prided itself on its independence, got a tax break in the Build Back Better bill passed by the House on Nov. 19.

The bill would provide a payroll tax credit for companies that employ eligible local journalists. The measure would allow newspapers, digital news outlets, and radio and television stations to claim a tax credit of $25,000 the first year and $15,000 the next four years for each of up to 1,500 journalists.

The theory is this would incentivize some publishers to hire or retain local reporters. The Democrats project the cost of putting journalism outlets on the public dole will be $1.7 billion over the next five years, with an estimated $38 million of that injected into approximately 113 newsrooms in Oregon.

Supporters say there will be guardrails to prevent the tax breaks from going to partisan or fake-news sites. Good luck. The battles over eligibility will be never-ending.

I’m a former newspaper reporter and the struggles of local print news in our Internet-juiced landscape are undeniable, but why print journalism enterprises, or other journalism forms, deserve taxpayer bailouts like this is beyond me. And, unfortunately, you are not likely to read about criticisms of the bailout in your local paper. No surprise there.

Some tax credit supporters argue that government support for media goes back a long way, that the two have always been joined at the hip, so this new idea just continues long-established practices. The latest help is the pandemic-related small business loan program, for example, provided millions to news organizations.

Fundamentally, this argument is that print media already get some subsidies so they should get more. A dubious assertion that too many are willingly embracing.

Media figures also argue that the Build Back Better subsidies will only be temporary anyway. But let’s be honest. When was the last time you saw a government subsidy discontinued?[1]

It’s a given that when the subsidy ends in five years, newspaper publishers and others raking in the subsidies will be back in Congress hat in hand seeking an extension. The Congressional Budget Office estimates that if the subsidies continue for ten years, the cost will be $3 billion, far from small change.

It’s also defies logic that taxpayers should subsidize already well-off newspapers.

One of the vocal tax-break supporters, for example, is The Washington Post, owned by tech billionaire Jeff Bezos since 2013. According to Americans for Tax Reform, if the tax break becomes law, Gannett, one of the nation’s largest remaining newspaper chains, could gain as much as $127.5 million in tax benefits over five years.

And why should the government give breaks to papers owned by super-rich hedge funds?

Hedge fund Alden Global Capital, for example, is one of the country’s largest newspaper owners. It has been buying up newspapers, imposing draconian cost cuts, and implementing widespread layoffs. Its current target is the local newspaper chain Lee Enterprises, whose Oregon titles include the Albany Democrat-Herald, the Corvallis Gazette-Times and the Lebanon Express.

Local print newspapers have been a key element of our civic life for generations, but Build Back Better’s tax breaks are not the solution to the challenges they face. And despite the special show of neediness among many newspaper people these days, we won’t be doing them a favor if we succumb to their pleading.

Maybe a little creative destruction is in order, instead.

—————–

[1] The situation with the federal child tax credit (CTC) is a classic example of the never-ending subsidy. The CTC is not new, but it was expanded in the March 2001 American Rescue Plan (ARP). Before the ARP, parents were eligible to receive up to $2,000 in tax credits every year for each child under 17 they claim as a dependent. The benefit began to phase out at $200,000 of annual income for single filers and $400,000 for married couples filing jointly. Families had to earn just $2,500 a year to qualify. Parents claiming the credit would receive it as one single refund at tax time, and the credit was partially refundable, meaning families with a tax burden smaller than the size of their credit could still receive up to $1,400 per child.

The ARP increased the program’s benefits, raising the maximum credit to $3,000 for every child aged six to 17, and $3,600 for children under 6. The new credit was fully refundable. In 2021, half was paid out in monthly installments, with the rest to be meted out in families’ annual tax return.

The ARP expanded the CTC only through 2021. Democrats figured it would prove to be so popular they could extend it indefinitely. So far, they haven’t been able to secure enough votes to do so, but efforts to do so were still underway at the end of 2001.