Update 9/24/2025: I see a lot of electric vehicles (EVs) around town, but apparently looks are deceiving. As of May 2025, 119,850 “zero emissions vehicles” (ZEV) were registered in Oregon, equaling 3.2 percent of the total vehicle fleet, according to the Cascade Policy Institute. Of those, only 84,636 were true zero-emission vehicles powered entirely by a battery. The remaining 35,214 vehicles were plug-in hybrids, which still rely on gasoline. The numbers show Oregon has reached just 34 percent of former Governor Kate Brown’s EV Adoption Targets established during her era.

The hoopla was energizing.

On Oct. 26, 2019, PGE celebrated the grand opening of its Eastport Plaza Electric Avenue EV charging station at 4000 SE 82nd Avenue in Portland.

“These charging stations are important to the mission of PGE, because we are committed to doing our part in solving global warming and Climate Change,” said PGE’s President & CEO, Maria Pope.

The Eastport Plaza location joined already operating Electric Avenue operations in Milwaukie, Hillsboro, Wilsonville, and downtown Portland.

Smiling PGE officials, representatives from TriMet, the City of Portland, and Multnomah County enthusiastically cut a ribbon to officially open the new 82nd Ave. charging station.

The national mood on EV’s was optimistic, too.

Global plug-in vehicles come in two basic varieties—all-electric (BEV) and plug-in hybrids (PHEV). Dd

More than four years later the mood is considerably less upbeat.

The pace of adoption has markedly slowed, and analysts have suggested the country is no longer likely to hit the federal government’s sales targets. Government targets for EV sales in 2024 call for each car manufacturer to hit 22% electric vehicle sales or face hefty fines. EV experts are warning the growth rate in electric vehicle uptake simply isn’t strong enough to make that target.

Earlier this week, dealers representing about 5,000 stores wrote to President Biden saying the charging infrastructure remains scattershot and unsold EVs are piling up on their lots. The letter urged Biden to “hit the brakes” on an EPA proposal that could codify the agency’s strictest-ever tailpipe emissions limits, proposed last April.

“Mr. President, we share your belief in an electric vehicle future,” the latest letter says. “We only ask that you not accelerate into that future before the road is ready.”

This followed an earlier November letter from about 4,000 dealerships calling on Biden to reconsider the proposed regulations, which they argued would mandate an unrealistic shift to battery-electric vehicles in the U.S.

A recent visit to the Eastport Plaza Electric Avenue charging site offers some reasons why manufacturers and dealers are getting antsy about EVs. And potential buyers, too.

The site has four DC fast chargers and two Level 2 chargers.[1] When I pulled in riding in a Nissan Leaf, one of the charging ports was broken. I was later told it had been broken for months. The three other fast chargers were in use. One vehicle was at 86% charged, one at 39% and the third at 22%. Only the 86% vehicle was occupied.

Broken charger at Eastport Electric Avenue

Choices open to us were to use a slow Level 2 charger or sit and wait for one of the fast charger slots to open up. Unlike at a gas station, there’s no assurance the vehicles ahead of you will move on in a timely manner.

We encountered similar issues at PGE’s Electric Avenue site in the heart of downtown Milwaukie at the corner of SE McLoughlin Blvd. and Jackson St.

As at Eastport, the Milwaukie site has six charging ports, four DC fast chargers and two Level 2 chargers. All four fast charging stations were occupied with no drivers in the vehicles. One vehicle was at 59%, one at 74%, one at 59% and one at 89%. One of the slow Level 2 chargers was being used, with the driver in the vehicle.

It is considered acceptable to leave your vehicle unoccupied while it’s charging, It used to be common EV etiquette, however, that when your vehicle was at 80% you would make way for another vehicle if others were waiting.

The U.S. Department of Energy still says, “Unless you truly need every ounce of driving range available in your vehicle, consider unplugging your electric vehicle when it has reached 80 percent charge or an acceptable charge level for your immediate driving needs.”

EV owners tell me the 80% rule is, however, now commonly abused. Another common abuse is leaving a fully charged vehicle unoccupied for an extended period, with no way for a waiting driver to know how long the wait will be. One EV driver can tell how much longer another EV needs to charge by reading the digital readout on the charger stating the EV’s current degree of charge and the length of time for its charging, but that doesn’t guarantee the vehicle owner will unplug in a timely manner.

The Department of Energy also urges EV owners not to consider charging sites as resting places. “An EV owner will often use a charge point as an hours-long parking spot versus a place to recharge and go,” the Department says. Doing so, of course, adds an extra problem in that extra-long periods of charging time tops off the battery, which is not optimal for EV performance.

Then, of course, there are gas and diesel vehicle owners who see open charging spaces as prime parking spots. “In a crowded parking lot, the sight of any open electric car charging spot can be too tempting for some to resist,” the Department of Energy warns.

PGE’s charging stations accept all major credit cards, but if you want to sign up for pre-paid or monthly subscription pricing for Electric Avenue chargers, things get a little more complicated because PGE has partnered with Shell Recharge to accomplish that.[2]

First, you have to download the Shell Recharge app to your phone in the Apple App store Google Play store or order a Shell Recharge RFID card.

When you’re ready to charge your vehicle, you have to activate a charging session through the Shell Recharge app or scan your Shell Recharge charging card. If you are at an Electric Avenue charger, you can select “subscription” in the app if you’d like to pay just $25 per month for unlimited charging at Electric Avenue chargers or choose another preferred payment option. When you’re done, your card will automatically be charged for the session.

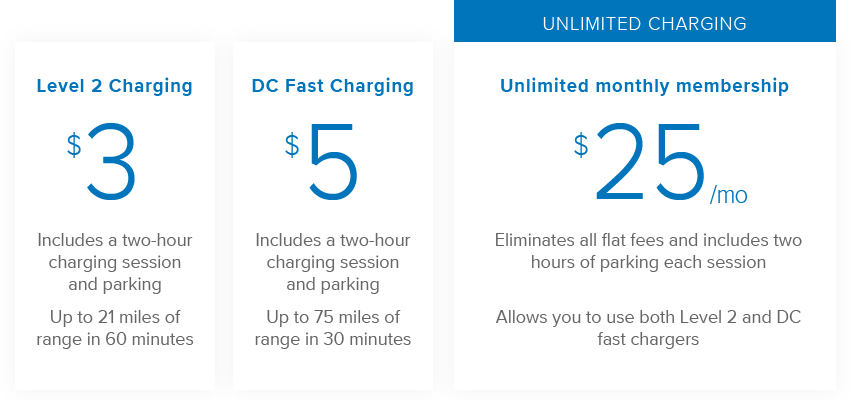

Charging prices at PGE’s sites are:

Source: PGE

Unlike at a gas station where the price per gallon generally stays the same 24/7, prices may vary during peak times (weekdays from 3 to 8 p.m.) During this period, PGE says $0.19/kWh will be charged to your credit card or Shell Recharge account in addition to your $3, $5 or $25 unlimited pricing structure.

Whatever the price, Oregon’s hyper-projections for electric vehicle adoption are proving to be wishful thinking. And it’s probably not just about EV prices, battery life and range. Unless you have a charging station at home, you are forced to rely on public chargers, and that, as we discovered, can be a frustrating challenge.

On Nov. 6, 2017, Gov. Kate Brown signed Executive Order 17-21 stating “It is the policy of the State of Oregon to establish an aggressive timeline to achieve a statewide goal of 50,000 or more registered and operating electric vehicles by 2020.” (emphasis in original).

In 2019, Senate Bill 1044 set a target of 250,000 registered Zero Emission Vehicles on Oregon roads by 2025. In December 2022, Gov. Brown, in a burst of environmental overreach that slavishly followed California’s lead, announced that all new cars sold in Oregon would have to be emissions-free starting in 2035.

The number of Oregon-registered zero emission vehicles on Oregon roads as of September 2023 was just 70,000.

The likelihood that this number will grow to 250,000 over the next 12 months is nil.

[1] There are three power levels at EV charging stations. Level 1 is the standard wall plug found in homes that delivers 120V. You will generally get only 2-5 miles worth of charging power every hour. Level 2 delivers twice the amount of power with 240V, offering 40-65 miles of charging power every hour. DC Fast Charge is the delivers 480V, which can fill 80% of most car batteries in 30 to 40 minutes.