No new taxes or fees!

That was one of the recommendations of Gov. Tina Kotek’s Portland Central City Task Force convened to consider the city’s most challenging problems and recommend ways to address them.

“Declare a moratorium on new taxes…” urges the Task Force report. “…elected officials should consider a three-year pause, through 2026, on new taxes and fees…”

Oh well, so much for that.

Your Portland property taxes, which were due Nov. 15, probably already went up and will likely go up again in 2024. According to the Lincoln Institute of Land Policy and the Minnesota Center for Fiscal Excellence, Portland ranked fifth highest nationally for effective property tax rate — a homeowner’s tax bill as a percentage of a property’s value — on a median-value home in 2022.

And Portland Commissioners Dan Ryan and Rene Gonzalez are already floating a November 2024 ballot measure that would raise property taxes to cover a $800 million bond for maintenance and new construction projects for the city’s parks and fire departments.

Oregonians are also already paying higher gas taxes. Oregon’s gas tax increased to 40 cents as of Jan. 1, 2024. That’s an increase of two cents per gallon from last year. The new rate keeps Oregon among the ten states in the U.S. with the highest gas taxes. Propane and Natural Gas Flat Fee increases also went into effect for qualified vehicles on Jan. 1.

Portlanders (and many more folks) are also facing increases in electricity rates. PGE customers can expect to pay 18% more on their power bills starting Jan. 1. The 2024 rate increase will cost the average single-family household an extra $24.59 each month.

And then there are all the taxes and fees the 2003 Legislature gleefully enacted.

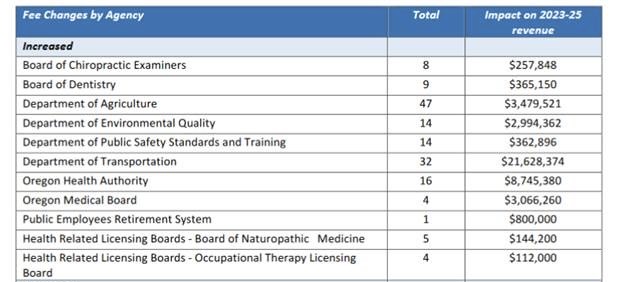

According to the Taxpayer Association of Oregon, Oregon lawmakers passed 185 fee increases (increasing existing fees and establishing new fees) in 2023 that will mean $47 million in higher costs.

Of those, 77 new or increased fees will directly impact the cost of medicine, hospitals and health care, which are all already straining the budgets of Oregonians. Another 47 fee increases will impact Oregon’s agriculture industry and consumers.

A list of 2024 fee increases by agency is below:

And then there are the new fees the 2023 Legislature created:

Portlanders and almost all Oregonians are also going to be paying a new cell phone tax this year. Starting January 1, 2024, a 988 Coordinated Crisis Services Tax will be added to the existing Oregon Emergency Communications (911) Tax. The new tax was implemented by the Oregon Legislature with the passage of House Bill 2757. The $50 million a biennium tax is slated to fund the state’s new 9-8-8 suicide prevention hotline.

DMV fees have gone up, too, touching just about everybody with a vehicle. For example:

- Class C driver license or restricted Class C driver license, increased from $54 to $58

- Commercial driver license, increased from $75 to $160

- Instruction driver permit, increased from $23 to $30

- Commercial learner driver permit, increased from $23 to $40

- Hardship driver permit application, increased from $50 to $75

- Fee for renewal of a commercial driver license, increased from $55 to $98

- Fee for knowledge test for a motorcycle endorsement, increased from $5 to $7

- Fee for a skills test for any commercial driver license, increased from $70 to $145

And the list of fee increases goes on, nickeling and diming Oregonians.

And of course legislators are busy thinking of new taxes.

For example, because the Oregon Department of Forestry wants more money to fight wildfires, Sen. Elizabeth Steiner, D-Portland, wants to charge every property owner in the state an annual fee to pay for what she perceives as a statewide issue.

And then, of course, there’s always inflation. It has been pushed down by aggressive Federal Reserve action, but in its long-term economic projections from December, the Federal Open Market Committee forecasted core Personal Consumption Expenditures Price Index inflation will drop from 3.2% in 2023 to 2.4% in 2024 and 2.2% in 2025.

But, still, hold on to your wallet. The state is considering tolls on I-205, I-5, U.S. 26 and Highway 217.

And the beat goes on.