Sometimes it’s nice to be first.

Oregon is justly proud, for example, that in 1971 it was the first state to pass a bottle bill to address the growing problem of litter from beverage containers and to encourage recycling.

Other times being first is an abomination.

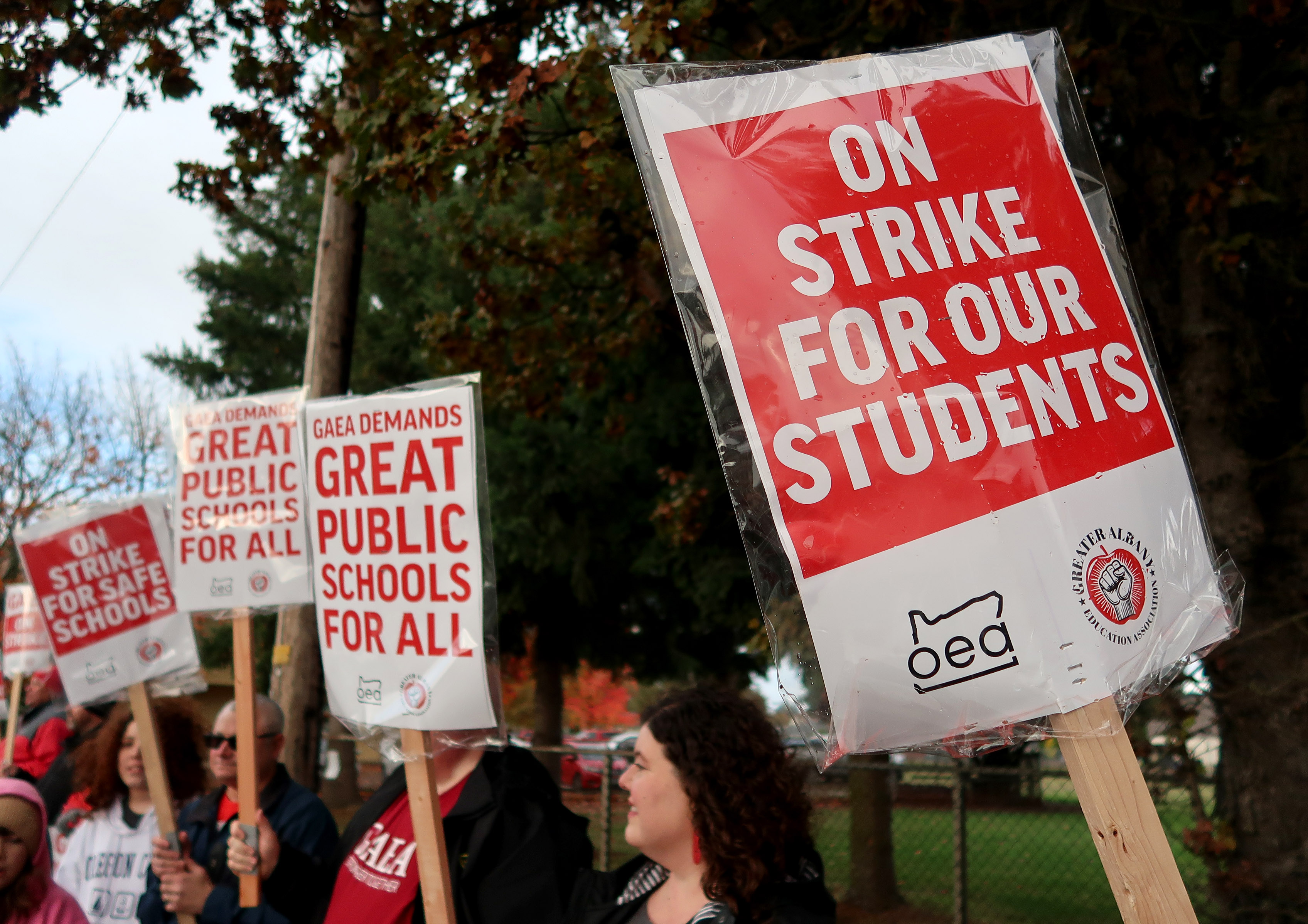

That will be the case if Oregon Gov. Kotek signs SB 916, which would award up to ten weeks of unemployment insurance benefits to workers who go on strike.

The Oregon Employment Department (OED) anticipates that the bill would result in an additional $2.1 million of benefit payments in the 2025-27 biennium. Critics of the bill say this doesn’t take into account the likelihood of longer and more frequent strikes if workers can count on some income while striking.

The whole concept of strikes is an assumption that the loss of income for workers and the loss of production by employers will motivate an eventual settlement. SB 916 would change that whole dynamic, putting employers at a disadvantage. Equally egregious, because the Unemployment Insurance Trust Fund is funded through a payroll tax that is paid by employers, Oregon employers would be paying workers not to work.

What makes their strong support for this bill particularly egregious is that it is aimed at benefiting an extremely small portion of the labor force, but a sector that overwhelmingly favors the Democrats in campaign contributions.

In 2024, just 15.9% of wage and salary workers in Oregon were union members, according to the Bureau of Labor Statistics. Dig deeper and you find that the union membership rate for public sector workers in Oregon, about 51%, is considerably higher. That is consistent across the country, where unionization is about five times higher nationwide in the public sector compared with the private sector.

Supporters of SB 916 often try to bolster their cause by alluding to the fact that New York and New Jersey already allow unemployment benefits to be paid to strikers, but they neglect to mention that both states bar public employees, such as teachers, from striking.

No wonder the bill has drawn across-the-board opposition from businesses and public entities, including already stretched local governments and school districts.

Earlier in the process, two Senate Democrats, Jeff Golden, D-Ashland and Janeen Sollman, D-Hillsboro, showed praiseworthy wisdom in voting against the bill. “Counties, cities and schools are scrambling to just maintain current services,” Sollman said. “Now is not the time to be adding more uncertainty and more expenses.”

Both senators subsequently changed their minds and voted for a scaled back bill, but Sollman’s statement is still valid. As Senate Minority Leader Daniel Bonham, R-The Dalles, said, “This is bad policy. It’s going to be harmful to our students. It’s going to be harmful to the state.”

Despite the financial strains facing Oregon, and even the likely diversion of kicker money to address forest fires, Gov. Tina Kotek, a Democrat with strong ties to labor, has said she plans to sign the bill.

“I know the argument has been that this will be highly detrimental to our school districts,” Kotek said in a June 9 media availability. “I don’t particularly believe that is an accurate assessment of that bill and at the end of the day I support the right of folks to strike and I believe the way the bill is drafted we will actually see shorter strikes.”

Don’t count on it.