The Human Rights Campaign once tweeted that we should all “Begin conversations with “Hi, my pronouns are _____. What are yours?”

Not so fast, critics have responded.

“Coercing people into publicly stating their pronouns in the name of “inclusion” is a Trojan horse that empowers gender ideology and expands its reach,” said Colin Wright, a fellow at the Manhattan Institute. “It is the thin end of the gender activists’ wedge designed to normalize their worldview. The effort to resist gender ideology is reality’s last stand. We simply can’t ignore fundamental realities of our biology and expect positive outcomes for society. “

The battle is on.

Much of the conflict has arisen in academic settings, including K-12 schools and colleges.

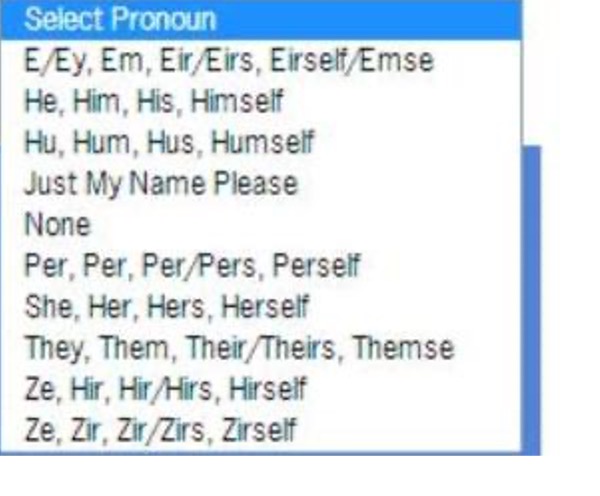

Students at Scripps College in Claremont, CA. have been advised that they can choose which of numerous different pronouns they want professors to use in addressing them.

Pronoun options were:

One student said the options were necessary protection from “institutionalized violence.”

Not to be left behind, the State of Oregon has embraced the same pronoun policies, turning appropriate pronoun usage into compelled speech.

In October 2021, Colt Gill, then Director of the Oregon Department of Education, used his Education Update email message to urge Oregonians to “Celebrate International Pronoun Day with ODE.”

“When we collectively share our names and pronouns, we can share the burden of fighting against injustice,” he wrote. “Pronoun sharing within the workplace and throughout school communities is an important opportunity to build trust and connection with transgender, non-binary, two-spirit colleagues, students, friends, and community members.”

Gill told educators:

- If you are comfortable, share your pronouns when you’re introducing yourself at the start of a meeting: “I’m (Name) and I use she and they pronouns”

- Change your Zoom name to include your pronouns, every time: Name, (she/they), ODE

- Include pronouns in your ODE email signature

In January 2023, ODOE issued Supporting Gender Expansive Students: Guidance for Schools. Included in the guidance is the following:

- Gender expansive students may choose to change the name assigned to them at birth to an asserted name that affirms their gender identity. Gender expansive students may also ask to be referred to by the pronouns that affirm their gender identity.

- Even if a student does not update their records, they should be referred to by their asserted name and pronouns Intentional or unintentional continuous misgendering of a student by refusing to use their asserted name and pronouns can potentially create a hostile environment.

- Schools should engage in student-led support planning for name and pronoun changes. Once the school and student have decided on a supportive action plan, the school should immediately take action to implement the plan.”

The guidance cautioned about disclosing the decisions students make. “To the extent possible, schools should refrain from revealing information about a student’s gender identity, even to parents, caregivers, or other school administrators, without permission from the student.”

When a local news outlet asked ODOE about the policy providing leeway to keep parents in the dark on official school transitions, ODE said this was for a “safety concern.”

On Oct. 19, 2023, the State Board of Education lent its weight to the pronouns dispute, adopting new health K-12 education standards that include:“Demonstrate ways to treat all people with dignity and respect, including people of all genders, gender expressions and gender identities” starting in the 4th grade.

The new standards will come into full effect in Oregon public schools by the 2025-26 school year.

Educators and other Oregonians who are less than enthusiastic about the progressive pronoun push may hope the campaign will abate, but it looks like the beatings will continue until morale improves and educators with the courage to challenge the received wisdom of the education establishment will be at risk.

An ever-growing list of pronouns have now become expressions of one’s self-proclaimed identity, a claim that proponents insist everyone must affirm—or else.

Some critics argue that all this is just capitulating to a politically correct, Orwellian effort to validate social progressive doctrines.

Others argue that the controversy is just a way for ideologues to browbeat people, to claim authority over how people speak and to allow language commissars to monitor incorrect speech in schools, workplaces and life.

Compelling expansive pronoun usage is a dramatic curtailment of freedom of speech, critics assert. As Graham Hillard, managing editor at the James G. Martin Center for Academic Renewal, put it, “When Big Brother arrives in the 21st century, he will appear not on posters but in grammar handbooks, HR manuals, and social media”

In the meantime, how should you navigate the rocky shoals of the pronoun wars without being chastised, harassed, berated and charged with insensitivity?

‘Tis a puzzlement.