Expelled New York Congressman George Santos, who has been indicted for stealing the identities of campaign donors and using their credit cards to rack up tens of thousands of dollars in unauthorized charges, isn’t the only master of credit card fraud.

The latest identity theft and credit card fraud statistics paint a bleak picture. There were 1.108 million reports of identity theft in 2022 and 805,000 instances of identity theft were reported from January through September 2023.

Aggressive fraudsters are active throughout the United States, including in Oregon.

In February 2023, Mariam Gevorkova was sentenced to five years in federal prison and required to pay $2.5 million in restitution for her involvement in a fraudulent credit-card scheme that funded two illegal marijuana grows in Oregon and cannabis shop in Corvallis.

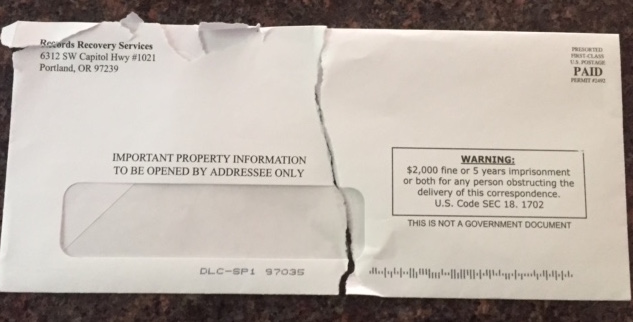

The newest broad appearance of credit card fraud in Oregon involves a slew of Japan, Singapore, Italy, Thailand, Australia, Taiwan, Hong Kong and United Arab Emirates- based banks. The fraud has become so pervasive that some local businesses are refusing to even the accept credit cards of specific banks.

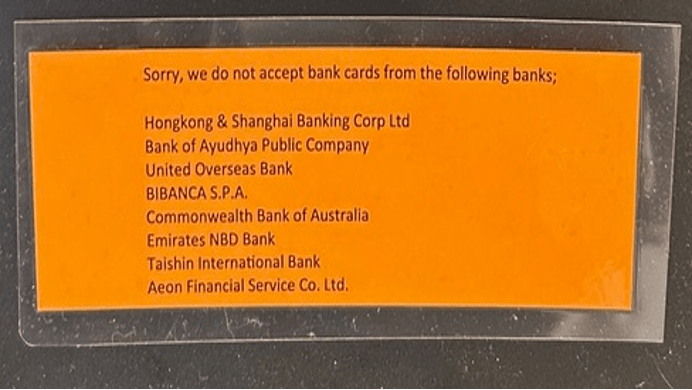

The A&W fast-food outlet in Sherwood, OR, for example is serving up more than its namesake root beer. It’s also serving up credit card warnings. Posted at its counter is the following advisory:

An employee at the restaurant said the posting was necessary because of fraud associated with the credit cards at the listed banks.

Complaints by customers of these banks are also piling up.

In March 2023, one victim reported receiving 11 notifications of unauthorized transactions on his Tokyo, Japan-based AEON Financial Services Co. credit card, each for the same amount of $549.74 within two minutes. The total amount of unauthorized transactions reached over $6,014.33.

A customer of Singapore-based United Overseas Bank (UOB), complained of multiple fraudulent payments made on his card. “Disgraceful. Tried to call their so -called fraud hotline 5 times. Wait ten minutes each time and get automated voice saying call back, operators too busy. In the meantime another fraudulent transfer happened…”

“I have 12 fraudulent transactions on the same day to the same US based company and not a single OTP (one-time passcode) received,” reported another UOB customer. “Your security systems of protecting customer’s money are a joke!!”

UOB recently acquired Citigroup’s consumer banking businesses in four key the Association of Southeast Asian Nations (ASEAN) markets.

A US customer of Dubai-based Emirates NDB Bank reported fraudulent transactions totaling $12,000. “2 transactions (were) done in Russia while I was in Dubai,” he reported. “As soon as I got the WhatsApp notification about the purchase, I called the bank and reported the fraud. On the phone the agent told me my credit card was cloned.”

If you have a credit card issued bv one of these banks and discover fraud on your account, you’re encouraged to report it to local law enforcement and the Federal Trade Commission (FTC). The FTC tracks incidents in a central database to help law enforcement investigate and prosecute these crimes.